Substantial sums of cash are required for large purchases and projects. While some people may save the funds they need, most people need to secure financing to afford significant expenses.

Once you understand how to secure financing, you must determine the best way to use the funds. Continue reading to learn about financing options and your options for how to use your money.

Lenders

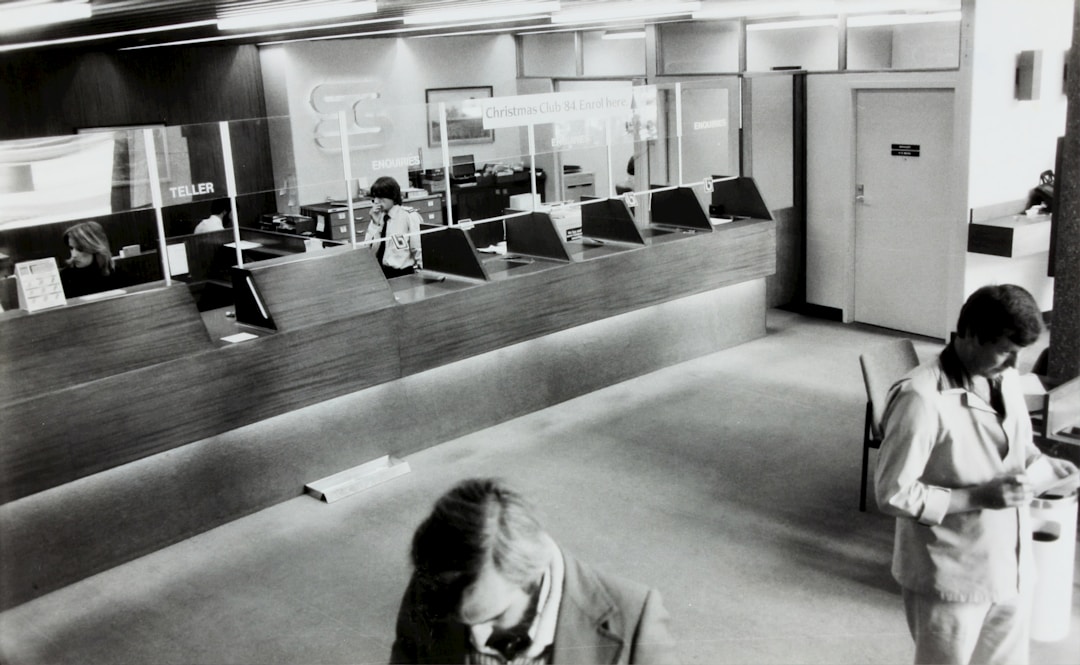

The four primary sources borrowers in the U.S. and abroad can apply to for financing are banks, credit unions, hard money lenders, and private money lenders. Banks and credit unions are traditional creditors. They review your income, income to debt ratio, and credit score to determine if they should approve a loan. Other factors, such as whether you’re a homeowner with collateral to secure the loan, may also be considered.

Borrowers can also capitalize on the advantages of securing a private money loan. Private money loans from sources such as Pacific Private Money connect investors and borrowers. The funding for private money loans comes from companies or individuals who want to generate revenue through financial investments. Private money loans may have a specific focus. For example, Pacific Private Money lends money to people purchasing real estate in California.

Real Estate

Whether you’re planning to put down roots in Northern Virginia or San Francisco, California, investing in real estate can be one of the smartest ways to use financing. You can eliminate rent payments and use your funds to build equity in your property.

Homeowners may also borrow money to perform crucial repairs or home improvement projects. While it may not be financially sound to invest in cosmetic changes, a roof or skylight that leaks can cause significant problems for homeowners. When precipitation gets inside your home, it can damage floors, ceilings, and support beams. If you’re moving to Northern Virginia, fo example, Google “Northern Virginia roofing contractors” to locate experienced contractors in your area who can perform crucial roof repairs, such as replacing missing shingles. You should also ensure your gutters are cleaned regularly to prevent water from building up on your roof. If you’re unable to do this yourself, hire contractors to clear your gutters for you.

Other critical home improvement projects include updating the plumbing, electrical, and heating, ventilation, and air conditioning (HVAC) systems. Outdated pipes can crumble, and build-up can cause blockages that cause sewage to back up in your home. Damaged or outdated electrical systems can cause house fires. Old HVAC systems will use more energy and inflate your energy bills. They’re also more likely to distribute toxins throughout your home.

Business Investments

Securing financing can enable you to start or expand a business. For example, if you have employees who travel between buildings on a large property, you may consider investing in autonomous vehicles to transport employees. Eliminating the need for human drivers can free up time employees can spend completing paperwork, filing reports, and performing other tasks. It’s a good idea to discuss this option with your insurance company, research National Highway Traffic Safety Administration (NHTSA) information about driverless cars, and review driverless car accident statistics before investing in autonomous cars.

Other business investment options include securing start-up equipment and materials, covering marketing costs, and hiring developers to create a business website.

Debt Management

If you’ve made some questionable financial decisions, you’re not alone. Many people incur credit card debt and struggle to pay off their bills. It’s also possible you have a car loan and student loans to pay off.

Debt consolidation is a common reason to borrow funds. Interest rates for credit card debt average 14.65 percent in the United States, while interest rates for automobile and real estate purchases are substantially lower. You may be able to secure financing at a lower interest rate, pay off your existing debts, and have a single low-interest loan to repay. Debt consolidation can increase your disposable income and improve your credit score.

Financing can be an effective way to afford crucial home repair projects, cover business expenses, and consolidate debt. Review options from multiple creditors to ensure you find the best financing option for your needs.