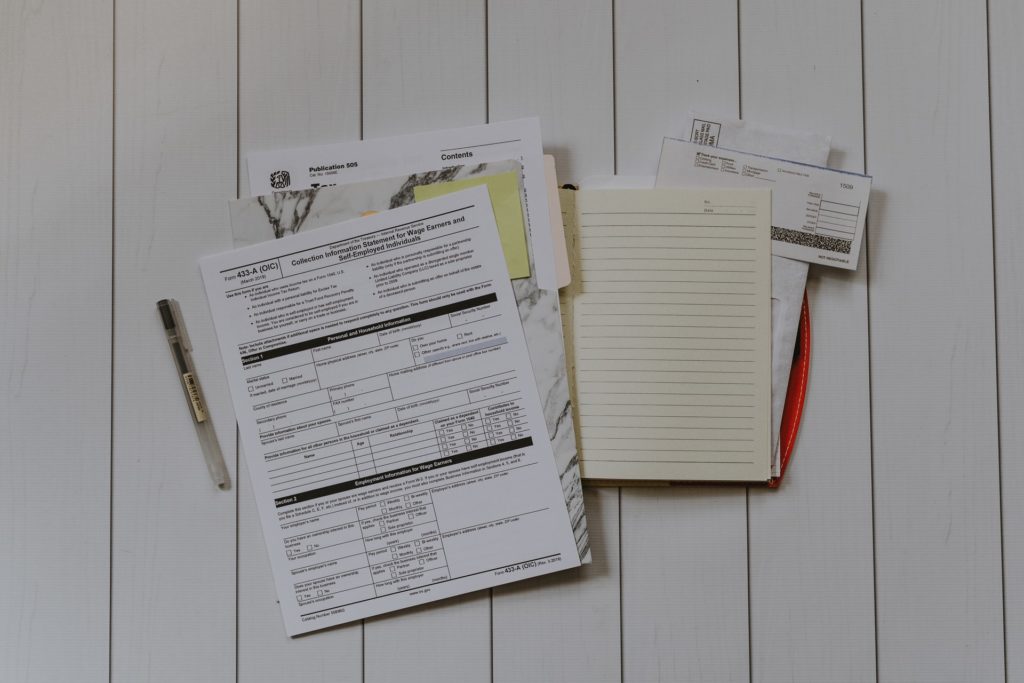

You need to be extra cautious when handling your tax documents. There are times when you rush to submit the paper to the government agency because you have to meet the deadline. As a result of rushing the process, you end up with documents full of mistakes. It’s not going to benefit your business, and it could even lead to possible losses.

Penalties and fines

Since you decided to rush the documents and there are tons of mistakes, the government could fine you for doing it. At first, you will have a chance to correct these errors. However, if they keep happening, you won’t receive another opportunity for an error connection anymore. Worse, the government will think of it as an intentional falsification of documents. Your business might end up receiving an order for foreclosure as a result. Anything can happen because you mishandled the tax document. Therefore, you have to do everything possible to avoid it from happening.

Keep the records up to date

You have to ensure that all financial documents are up to date. Any financial transaction also needs to be on the file. It doesn’t matter how significant the amount is. As long as the money comes in and out of business, it needs to be on the record. It’s easier to keep track of what’s going on if someone is making sure that no money gets disbursed without proper records. Every amount coming in also needs adequate documentation.

Apart from ensuring that you’re paying the right amount for taxes, it’s also important to document to avoid financial losses. You will know how much money you’re spending on certain expenses. You will also know if it’s time to cut down. There’s also no chance to corrupt the company’s money since everything is on record.

Partner with an accounting firm

If you’re running a small business, you might find it challenging to hire a lot of full-time employees. You need to prioritise jobs that are necessary to keep your business running. If you can’t afford to have a full-time accountant, you don’t need to worry. You can always partner with third-party firms. You can send your documents to the firm, and they will have someone looking into every item. If you need to have the tax document ready on a specific date, you can count on these firms to do the job. Check out www.gsmaccountants.co.uk for more information about accounting firms and the services they offer.

Make sure that you choose a reputable partner. You also have to check the terms to find out if they will be responsible for rechecking the documents for mistakes. Some firms would even go as far as taking the penalties given by the government if they made the errors. You will feel more confident about the document you’re handing over to the tax agency when you partnered with these accounting firms. You can continue the partnership in the future if you think it’s for the company’s best interest.