There is no more exciting time in your life than buying your first home. Although it is a big commitment, it marks a major milestone and gives you somewhere to call your own. Whether you plan to move in by yourself or with your partner, it really is a wonderful time.

Of course, as a first-time buyer, you have not been through the whole process before. This can make it all seem a little confusing or overwhelming. If you feel like you need some help in making that first move, read on.

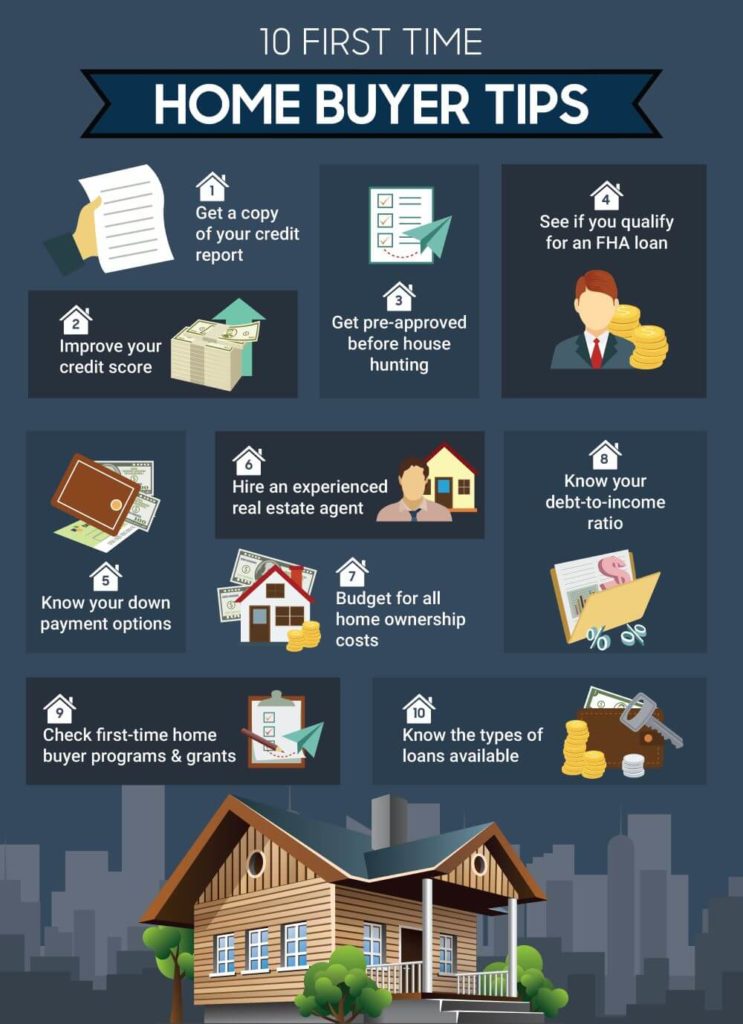

The best tips for first-time buyers in 2018

With so much to think about, it is always worth getting a few tips on how best to approach buying your first home. The below should give you just the helping hand you need:

- Think about location – This first tip actually is for before you buy your new home, but it’s worth factoring in anyway. Be sure to fully consider the location of any home you buy and what amenities it has close by. Also, be sure to check how easy it is to get to your work and any transport links available. All this will make sure you own your first home in an area that is suitable for your needs.

- Get to know your neighbors – In fact, it is great to get to know as many people in the local area of your new home as possible. Not only will this help you settle into your house but also help you integrate into the community. It will also mean that there are plenty of people to call on for help or advice if needed.

- Choose a home warranty – Ideally, you should try to take out a home warranty as a first-time home owner. These warranties are to cover against the repair or replacement of the major appliances and systems in your home. It is much safer and easier to budget for than suddenly getting a huge bill when your boiler or central heating system fails in the winter months.

- Think about your finances – Making sure to really think about your finances when you become a home owner is key. This is especially important for first-time buyers who might not have a lot of savings left in the bank to fall back on. These considerations should start before even buying your home, by asking yourself the question ‘How much home can I afford?’ and using this formula of 28% of your gross income to be sure. Once you are settled into your home, make sure to devise a budget to keep yourself financially stable.

Owning your own home is fantastic

There is no doubt that owning your own home is amazing as a first-time buyer. While there are lots of things to think about, both before and after the move, you will love having your own sanctuary to relax in. Take the time to think about the above tips and you will be able to look forward to a blissfully happy time in your new home.